NIBC’s Infrastructure business delivered strong results

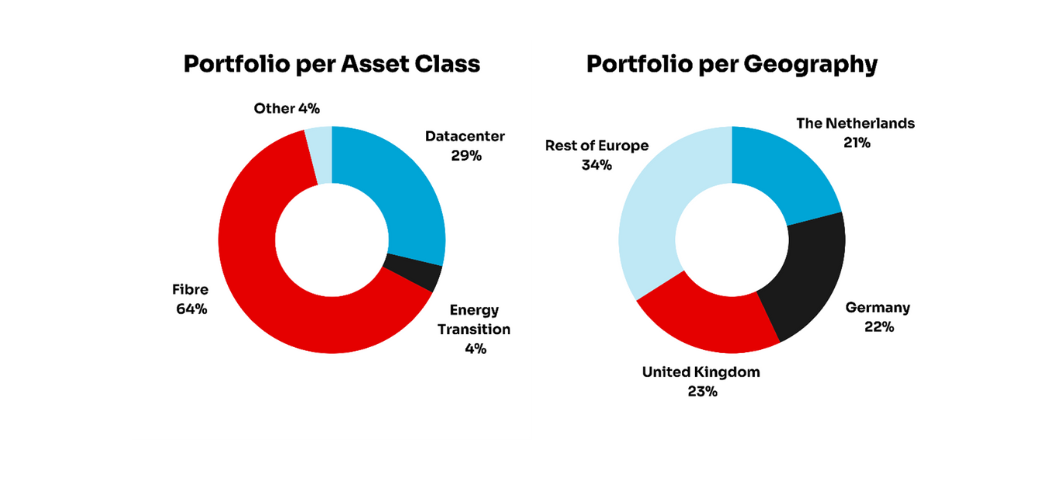

NIBC Infrastructure shows a strong performance in 2023, resulting in a growth of its portfolio of 22 percent to EUR 1,893 million, compared to EUR 1,545 million in 2022. This shows that the bank's successful transformation into a dynamic entrepreneurial asset-based financier pays off.

NIBC Infrastructure has played a significant role in funding digital infrastructure projects for valued clients such as Asterion, DIF, EdgeConneX, Netomnia, Onivia and MainCubes, Penta, EcoDataCenter and Gridserve.

In 2023, NIBC has continued to execute its focused strategy as an entrepreneurial asset-based financier. Backed by the launch of the new brand positioning at the beginning of the year, NIBC has further strengthened its proposition, resulting strong results in all core segments.

Jan Willem van Roggen, Head of NIBC Infrastructure:

“The 2023 results show that we are playing a significant role in funding digital infrastructure projects in Europe. Positioned as the 4th Loan Arranger in the European TMT sector by Infralogic's latest rankings, NIBC Infrastructure will continue to support digital infrastructure and energy transition projects in Western Europe with ticket sizes ranging from EUR 15 million to EUR 50 million.”

We see positive developments on ESG and we remain committed to greater sustainability and emission reduction. With the successful launch of our ESG Client Portal, NIBC Infrastructure remains committed to helping clients with their sustainability transition, and by financing the energy transition through EV charging and battery storage projects.

We refer to our Annual Report 2023 NIBC Holding N.V. published on our website for full details.